BLAIR, NEBRASKA (2025 August 24, Sunday)

Don Harrold, Writer / Editor

editor@blairtoday.com – Facebook

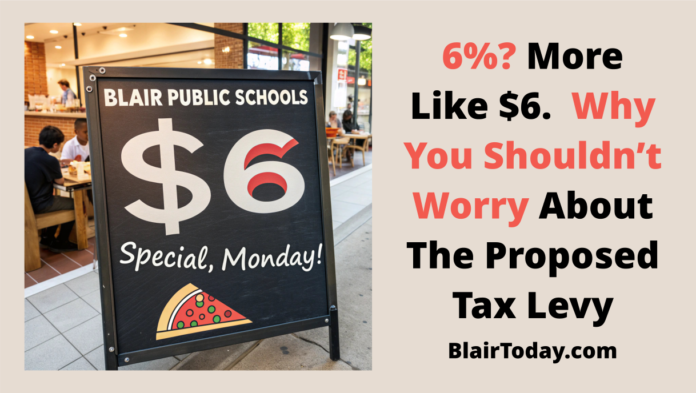

Blair Community Schools’ proposed “6% property tax increase” isn’t what it sounds like. The 6% refers to state budget authority rules, not your tax bill. For a $250,000 home, the actual impact would be approximately $5-6 more per month in school taxes—if the board chooses the higher budget option Monday. The alternative would actually lower taxes below last year’s rate. Even with the increase, Blair would keep the lowest school levy in Washington County (0.799 vs. Fort Calhoun’s 1.11 and Arlington’s 0.86) while funding a specific safety project. At 31% below their levy from a decade ago, Blair remains among Nebraska’s most tax-efficient districts.

When you hear “6% property tax increase,” you might panic. But that’s not what Blair Community Schools is actually proposing. Let’s break down what this really means for your wallet.

“I am guessing that this is where the ‘6% tax increase’ statement came from,” explains School Board Vice-President Courtney Tabor, referring to confusion about budget authority versus actual tax rates. The reality? “Last year the levy was .773. This year the levy would be .741 if the budget with the 3% cap is chosen or .799 if the budget includes the additional 6%.”

Here’s What This Actually Means for You (Approximately):

Based on the levy rates provided by the school board, we can estimate the impact on your school tax portion. If you own a $250,000 home in Blair, your annual school district tax would go from roughly $1,932.50 to $1,997.50. That’s an estimated difference of $65 per year – or about $5.42 per month.

Important note: These are estimates based on a simplified calculation using the district’s levy rate. Your actual tax will depend on your property’s assessed value (which may differ from market value), homestead exemptions, and other factors. The actual impact could vary by 10-20% from these estimates. This also represents only the school district portion of your property tax bill – not city, county, or other taxing entities.

To put that in perspective: Even if our estimate is off by 20%, we’re talking about $5-7 per month. A family of four going to see a movie with popcorn and drinks will easily spend $60-80 for one evening. A single pizza delivery with tip runs about $30-40.

In fact, if the board chooses the lower budget option, your school taxes would actually DROP.

“How much this will affect each household is dependent on each homeowner’s valuation and how much their valuation went up,” Tabor notes. With property valuations rising across the district by over 6%, many homeowners might see little change or even a decrease despite the levy adjustment.

Why Blair Remains a Bargain:

School Board President Kari Loseke puts this in historical context: “In Blair our levy was 1.161 ten years ago and today it’s .773.” Even with the proposed 0.799 levy, you’re paying roughly 31% less than a decade ago.

“We have the lowest levy in the county and are one of the lowest in the metro area,” Loseke states, and the state data confirms this.

How Blair Compares:

According to Nebraska Department of Education data for 2024-2025:

Washington County:

- Fort Calhoun: 1.1100 (44% higher than Blair)

- Arlington: 0.8638 (12% higher than Blair)

- Blair: 0.7733 (the lowest in the county)

Even if Blair adopts the 0.799 levy, they would still have the lowest rate in Washington County by a significant margin.

Statewide Context: Blair’s 0.7733 levy ranks among the lowest quartile of Nebraska’s 244 school districts. For comparison:

- Omaha Public Schools: 1.1079

- Lincoln Public Schools: 1.1091

- Millard: 1.1180

- Papillion-La Vista: 1.1236

- Bellevue: 1.1576

- Gretna: 1.3497

Many rural districts also operate with much higher levies, including Shickley (1.6200), Gering (1.2999), and Plattsmouth (1.2098). Blair’s fiscal efficiency stands out across the state.

What’s At Stake:

This isn’t about padding budgets or wasteful spending. Tabor is clear: “If the budget with the levy of .799 is chosen, that money will be used for a specific safety project that cannot be done using the .741 budget.”

The district is asking whether spending an estimated additional $5-7 per month per household is worth funding a specific safety project for students, especially after a decade of underfunding that left the district with 17-year-old buses and 16 years without new reading curriculum.

“The decision is never easy and believe me I know the property taxes in Nebraska are too high,” acknowledges Loseke. “Being a good steward of tax dollars is a top priority of mine.”

Editor’s Thoughts:

This isn’t a “6% property tax increase.” It’s a choice between:

- Lowering the school levy to 0.741 (saving money but unable to fund the safety project)

- Raising the school levy to 0.799 (costing the average homeowner an estimated $5-7 per month for student safety improvements)

While individual circumstances vary and these numbers are estimates, the magnitude is clear: we’re talking about a nominal monthly amount, not a budget-busting increase. Either way, Blair taxpayers will continue to have one of the best educational bargains in Nebraska – maintaining the lowest school tax rate in Washington County and remaining among the most efficient districts statewide.

So, unless there is something the School Board hasn’t told us, or if simple math no longer works, this “6%” is not something to be angry about. Should taxes be lower – across the board? Yes. Should we expect our leaders to cut costs and become more efficient with how they spend local funds? Absolutely. Would I like to find a way to lower taxes, cut expenses, and raise the quality of our local schools (already some of the best in the nation)? You bet. And, it’s a fair question to ask whether taxes are too high, IN GENERAL.

But, in this case, Blair schools are led by folks who navigate a tough environment while they ask homeowners to share a slice of pizza to help our kids in school.

I – personally, me, the editor of BlairToday – always look for the most efficient way to do what it takes. If I had a vote, I would always vote for what costs less, asks less of taxpayers, and provides more. But, until I’m on the School Board, City Council, or in the Mayor’s office, I will lean heavily on numbers like these. And, this article does not endorse raising taxes, it’s an attempt to raise awareness about the facts so you can make up your mind, and you can contact the school board with questions and comments BEFORE THE VOTE. (And, on that note, I’ve been told by one board member that, so far, not one person has emailed or called to lodge a complaint about this issue or ask a question.)

Which is why I hope you will join me Monday at 5PM to learn more, directly from the School Board.

The board votes Monday at 5 p.m. at the Central Office. Property owners with questions should contact the county assessor’s office for more precise calculations.

[…] Blair Community Schools Board of Education failed to pass a proposed tax levy increase Monday night after passionate debate, with a 4-3 vote falling short of the supermajority […]